■ SKILLS IN PLAIN ENGLISH: I enjoy adding value to demanding senior clients globally from the Asian region ■ HOW? Market Analysis, Trade idea inception, Deal advisory, Deal Execution, Business building ■ CLIENT EXPOSURE: 12 years of daily work with demanding global portfolio managers, physical traders, Forbes business creators ■ BUSINESS BUILDER: Energy and track record in developing a loyal client franchise and sustainable business ■ BROAD LINGUISTIC ABILITY and cultural background ■ STRENGTH: Perspective in markets and business, Freshness in pursuing a business plan, Harmony with my Clients across countries covering 30% of Earth’s population.

Commodity Markets

Personal Profile

- Name: Георгий Данелия | George Danelia

- Expertise: Commodity markets | Deal structure | Deal execution | Client relationships | Asia

- Last Revenue: $5 000 000

- Return on Investment (2015): 164%

- Net Profit Margin (2015): 68%

- Value: Adaptability + Languages + Track record + High Energy + Partners & Client portfolio

- Background: German nationality | Russian culture | Singapore residence

- Date of Birth: 1981 (34 years old)

Product Knowledge

Energy

Oil & Oil products

Metals

Base & Precious Metals

Bulks

Iron Ore & Coal

Index products

Enhanced Beta, Risk Premia / Alpha, Custom indices

Structured Products

Exotic options, TARNs, Phoenix, various other structures

Recently Used Skillsets

![]() Product Knowledge & Education

Product Knowledge & Education

![]() Market Analysis & Ideas

Market Analysis & Ideas

![]() Cross Asset Cooperation

Cross Asset Cooperation

![]() Business Development (New Clients)

Business Development (New Clients)

![]() Relationship Management (Existing clients)

Relationship Management (Existing clients)

![]() Communication (Languages)

Communication (Languages)

![]() Deal Execution (High margin)

Deal Execution (High margin)

Languages

12 years in Commodity Markets

Professional Experience

2013 Dec - 2016 Mar

Morgan Stanley

Vice President, Distribution

- My greatest achievement yet. Created a profitable and scaleable business from ground up in worst market conditions this decade.

- Independent entrepreneurial work.

- Highly diversified client portfolio marked by strong relationships driving high margin business.

- Rigorous business planning to leverage MS franchise strengths. Creativity to overcome significant limitations.

| Result: 2013 → $0 | 2014 → breakeven | 2015 → 164% ROE. | |

|

|

2012 Dec - 2013 Dec

Rigas Dynasty

Director

- Singapore company dedicated to providing advisory services to select number of Forbes individuals.

- Management consulting project in the Energy market, specifically Oil Refinery business.

- Advised owner of one of very few Russian 2.5mio tonnes coastal refineries (most of other refineries are located 1000 – 2000 km away from port). An important advantage was that the port is owned by the Company.

2009 Aug - 2013 May

Barclays Capital

Vice President, Distribution

- Hired to build the Asian commodities flow desk by Head of Asia (Peter Rozenauers) in 2009.

- Revenue just over $6mio in 2011 – representing over 50% year-on-year growth. $4.5mio in 2012.

- Business model snapshot: Asian physical commodities dynamics = valuable themes = relationship with senior fund managers = trade idea execution at high margin. And: sharp value-add coverage to Asian clients and connection to senior Western PMs.

- Phase 1 focus: funds & institutional clients (central banks, sovereigns, private banks). We ran this business with an FX model: energetic communication, sharp execution, content-driven (trade ideas). Added relationships with senior portfolio managers, particularly as top tier funds began migrating to Singapore. Responsible for Taiwan coverage in Asia. Overseeing Chinese sales team to improve quality of relationships and flow coverage with Chinese trading houses / corporates.

- Phase 2 focus: understanding physical commodity client businesses, particularly China and Central Asia/CIS. Added business development responsibilities for China and Central Asia. Organised personalized business trips for senior institutional decision makers to Shanghai and other parts of China, Kazakhstan, Kiev, Moscow and Urals.

- Proximity to businesses in China through strong flow execution and repo financing.

- Product focus: 30% Base, 30% Precious metals, 25% Energy, 15% Agriculture

| Top 5 institutional relationships: | Top 5 corporate relationships: |

| GIC, Tudor, Fortress, Highbridge, Barclays Wealth | C. Steinweg, Trafigura, Bayin Resources, Codelco, Gazprom |

2008 Jun - 2009 Sep

D&D Pharma

Director

- Innovative biotechnology small-cap started by the Family. Focus on affordable Personalised Medicine.

- Role: investor relations, management reporting, business strategy.

- Projects: lead negotiations and due diligence in growth financing deal; expanded company operations in Asia.

2004 Jun - 2008 Jun

UBS Investment Bank

Senior Associate, Commodities trading desk

A fast-paced role as one of the original five person team that started a commodities business at UBS. Recipient of the UBS Thank You Award for outstanding contribution to business development.

(London-2004)

- Foundation in trading: kept track of risk/positions across the curve in a very active market, option expiries, responsible for all FX hedging, developed middle office systems, risk-managed Asia books.

- Served a wide range of entities: Key Private Clients as well as their Fund and Corporate interests.

(Singapore-2007):

- Mandate to grow the Base and Precious metals franchise among Asian asset managers, particularly UBS Wealth Management.

- Management: directly responsible for a team of 4 juniors on the desk. Managed the due diligence process to open all desk client accounts and effective coordinator of all support functions for the desk (legal, credit, back office, on-boarding etc).

(Switzerland-2006):

- planned and delivered a two-months long marketing roadshow to UBS Key Private Clients across Switzerland to develop regional investment flows.

- Delivered an education programme to senior clients together with their private bankers in London, Switzerland and New York.

Shanghai (June 2004 – June 2005), Fixed Income

- Sole responsibility for a UBS business development project in Shanghai. Gathered key market intelligence and was responsible for building relationships among key market players. The project culminated in a successful UBS expansion in Shanghai.

2002 Mar - 2002 Jun

Freshfields Bruckhaus Deringer

Associate

Assistant legal position in Corporate & Trusts division of Magic Circle international law firm.

Places that shaped me

Timeline & Places

LLB | M.Sc | B.Sc

Education

2007 Mar - 2007

UBS Investment Bank

Continuous Professional Training

Advanced stage of 4 weeks continuous applied finance education in Hong Kong. Course was lead by Dr. Joe Troccolo (http://noscopartners.com/who-we-are), a former trader at the renowned O’Connor & Associates, largest market maker in the financial options in the U.S. in the 1980’s.

Examinable modules were: Optionality, Portfolio Analysis, Energy Markets, Advanced Derivatives, Capital Markets.

2005 Jan - 2005 Dec

Jiao Tong University

Diploma in Chinese Language

Satisfied my curiosity by completing the official language course at the famous Jiao Tong University. Jumped to 3rd level after first month. Spoken Chinese exam above 90%.

Most importantly, was accepted as the only foreigner in the famous university basketball team which was previously home to Yao Ming. Shared the dormitory with my team mates. National competition travel. I spent all day, every day with my team mates being the only foreigner and am infinitely grateful to have learned so much about Chinese people.

2003 Sep - 2004 Sep

London School of Economics & Political Science

Master of Science (M.Sc.) in Law and Finance

Focused on European Union commercial law, specifically to what extent anti-monopolistic regulation reflects financial theory. Final dissertation analysed the then newly created Credit Default Swaps.

Financed the entire degree and my living expenses myself through freelance programming work.

2003 Jun - 2003 Sep

Hong Kong University School of Professional Education

Special Course in the Law of Evidence

Focus on Forensics and Evidence in legal proceedings. Interesting course developing attention to detail.

2000 Sep - 2003 Sep

London School of Economics & Political Science

Bachelor of Laws (LL.B.)

Exciting degree involving analysing 20 legal cases per day and learning to understand complex judgements by thinkers like Lord Denning. Initially learned to structure and present arguments in writing, later to present in person.

Later focused on analysing Trust and Property law as well as European Union law.

Konrad Adenauer Scholarship recipient.

Research Assistant to Professor Sir Christopher Greenwood

1998 Sep - 2000 Aug

Cambridge Centre for Sixth Form Studies

A – levels, Mathematics, Economics, 4 Languages

Full Scholarship recipient. My first “deal”: at age 16, I suggested and justified the creation of a scholarship worth £50,000.

Recent Milestones & Firsts

Deals & Projects

-

Daily Analysis & Trade Ideas

-

Equity fund – Spec oil trade

-

China banks – Gold arbitrage

-

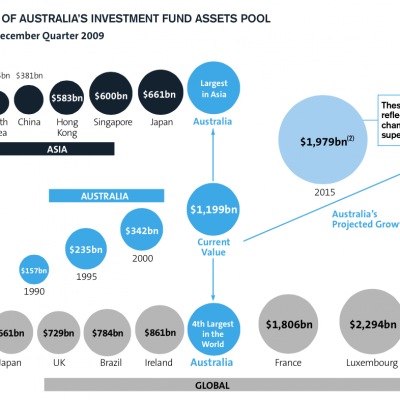

Custom Commodities Index in Australia

-

Protected: Australia Business Overview

There is no excerpt because this is a protected post.

- Reports & Client events:

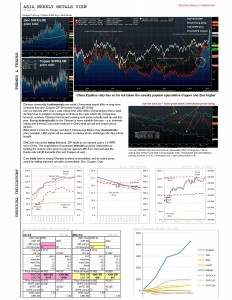

- Weekly Metals & Oil summaries

- Bi-weekly Blackrock conference call

- Monthly Australian Institutional client call

- Metals Portfolio 2014 (25 trades)

- Weekly Private Banks call

Regular Commodity Market reviews:

- Commodity Fundamentals: Supply & Demand, physical commodity flows

- Chinese arbitrage developments: How do locals trade in China?

- Base Metals, Crude oil, Iron ore, Coal etc.

- Technicals: Volume and Open interest view - Are international markets and domestic China markets at odds or trading in tandem?

- Option markets: Is volatility cheap?

Example: Weekly Review (April 2015 )

- Strange dichotomy: Equities are rallying in China, but Commodities are not...

- Fundamentals remain weak.

- Trade: selling Zinc, Copper, Coal.

- Technicals confirm new shorts.

- Volatility is good value: suggest expressing shorts via put options.

- Date: Q3 2015

- Client: Equity fund

- Product: Crude oil options

- Highlight: First deal with the client; high margin exclusive mandate

- Result: $600 000

Description:

The client was a HK-based diversified equity fund with underlying positions in crude oil exploration and oil services. Through extensive market analysis by a dedicated analyst the fund also decided to undertake short term horizon oil trades to make use of underlying market volatility. Options were chosen to limit risk. An opportunity to buy call options before 3Q end presented itself and low delta call options were exclusively executed. This was the largest options deal for our desk year-to-date. Several days later, the market rallied and the client took 500% profit unwinding the position exclusively with me.

We continued to trade oil options with the client on this relationship basis.

- Date: Q1-Q3 2015

- Client: Key Commercial Bank

- Product: Gold and Silver spot

- Highlight: New business; First deal with the client; high trading volume won

- Result: $250 000

Description:

Started the MS gold and silver arbitrage business with Chinese banks. When the arbitrage is positive, Chinese banks with (and sometimes without) physical import licenses buy LBMA gold and sell onshore Shanghai Gold Exchange gold to fix a low risk profit. Banks would also look for physical delivery capabilities and when the arbitrage window is closed they lease gold for a low risk profit.

In 2015, I executed the first stage of my business plan to deal with Top 5 Chinese precious metals banks. I have undertaken quarterly business trips to bring onboard the first client in 2015. Given our sharp pricing capabilities, we secured Asian hour volumes of 200,000 ozs Gold and 8,000,000 ozs Silver in March 2015 (arb window was open for the first time) with just one client.

I enjoyed working with client traders a great deal personally and found building our relationship very rewarding. I equally believe that this business presents a significant, scaleable opportunity in China.

Importantly, this flow provides the trading desk with real-time information on arbitrage conditions in China.

- Date: Q1 2015

- Client: Key Asset Manager

- Product: Commodities indices

- Highlight: First deal with the client; high margin

- Result: $1 000 000

Description:

In a cross asset effort with my Australian fixed income partner, we have assisted a key Australian asset manager to create a specific commodities index as a long-term portfolio overlay.

We have won the mandate exclusively and fixed very attractive fees, avoiding fee contraction throughout 2015.

This was the first deal with this asset manager and brought the bank back onto the counterparty panel list. We consequently closed more index mandates. Result: more than $1mio revenue in 2015.

- Date: Q4 2015

- Client: Private Equity fund

- Product: Gold options

- Highlight: Significant relationship with client; Partnership with Investment Bank

- Result: $1 000 000

Description:

Early on in 2015, during my business planning month, it has become clear that Private Equity funds are not invested due to asset owners being unwilling to sell at current market valuations, insisting instead to lock into a trailing average price. There was pressure on PE funds to invest, and as sellers began to agree on current market price valuations in view of another bad year for commodities, assets began changing hands. PE funds immediately implemented sophisticated hedging programmes. I have positioned my business to service a specific range of PE funds for exactly this purpose.

Competing with GS and another house, we have won most of the option hedging tranches in a large 2015 Gold mine deal. We have also won a significant portion of this business against lending banks, without providing any financing, yet without engaging in a "price war".

The overall result was revenue in excess of $1mio USD. It required a close relationship with the client, where real value was added to the Fund, as well as cooperation with my partners from Investment Banking. Very close work with the Trading desk was also absolutely key.

Colleagues & Partners

References

Diversity of Interests

Awards & Interests

King's Cup Regatta

2nd runner-up behind Thai Royal Navy in 2010 King’s Cup Regatta – biggest sailing contest in Asia. Foredeck crew on ship “Men-At-Work”, IRC 2 class.

Best Public Suggestion Award

Winner of Singapore Ministry of Manpower Best Public Suggestion Award 2009.

Competitive basketball player

Competitive basketball playerDevelops team coordination and execution under pressure. Captain of the University team, Captain of the Singapore amateur league winning team

Interests in Programming (IT)

Interests in Programming (IT)Worked as freelance programmer/scripter during studies. Develops complex abstract thinking.

Interest in Biotechnology

Interest in BiotechnologyActive interest in life sciences due to its exponential complexity. Completing a life sciences degree in 2017

Piano education since 1987

Piano education since 1987Musical instruments exercise abstract connective thinking which helps in business planning.

Represented by George Johnson